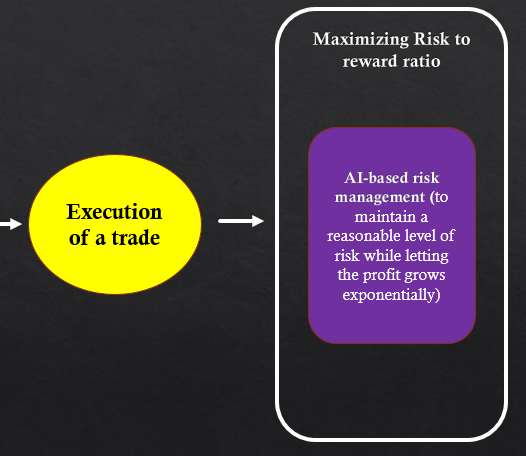

Our main superiority lies in AI-based risk management.

One of our core superiority lies in our AI-based risk management approach. To effectively manage risk and uphold a predefined maximum drawdown threshold, we employ sophisticated mathematical computations. These computations are translated into an algorithm that seamlessly integrates into each trade, providing guidance throughout the trade execution process. Our comprehensive risk management strategy encompasses various tools and concepts, including:

- Maximum drawdown analysis,

- Risk per trade evaluation,

- Daily loss limits,

- Implementation of giveback rules,

- Utilization of stop orders and bracket orders,

- Integration of trailing stops.